Jun 3, 2019

FinTech Onboarding via e-post: Gör du allt du kan med din Campaigns?

There’s no denying that financial technology – fintech – is booming these days.

Just last year, flera fintechföretag added billions in both revenue and funding, and analysts are nothing but positive about the future. With their high growth potential and investors’ hunger for disruptive innovation, Goldman Sachs uppskattningar that fintech startups will swipe 4,7 biljoner USD i omsättning och 450 miljarder USD i vinst from traditional financial services companies.

There’s no denying the future looks bright. But even as they take off, they face many of the same challenges as their unsexy brethren when it comes to marketing and growth. Like how to optimize their use of email, särskilt when it comes to mounting successful onboarding campaigns.

As fintech provider Rand förklarar, welcome emails are important. So important, in fact, that they can drive tre gånger the transaction and revenue per email than other promotional emails. That’s a substantial chunk of future revenue, so maximizing onboarding is vital.

Med detta i åtanke ska vi titta på några av de största utmaningarna som fintech-företag står inför när det gäller onboarding, och de bästa metoderna som kan hjälpa onboarding-mejl att övervinna dem.

Droppa i dem!

Onboarding shouldn’t just be a one-shot email drop, särskilt if you’re trying to acclimate a new user to using a fintech solution’s features (and making upgrades). A classic example from the brick-and-mortar banking world that still proves a good point: Armed Forces Bank elected to experiment with doing en serie e-postmeddelanden om introduktion, six in all, in lieu of just one.

When they sent out the series with timing that accommodated the schedules of their customers – military servicepeople – they saw a 40% lyft in new savings accounts, versus those who only got a single onboarding email. And these customers also increased their account balances and kept more of them open.

Denna "droppande" onboarding-metod kommer att fungera även inom fintech. Hur kommer det sig? För att du gradvis bygger upp en relation med användaren och visar respekt för deras liv och dess krav. Om du förtjänar den respekten får du chansen att skicka fler meddelanden till dem.

Lärdomen av detta? Att utvidga budskapet och gradvis bygga upp en relation med användarna kan ge bättre affärsresultat jämfört med ett enstaka e-postmeddelande.

That’s why fintechs like PayPal make onboarding a journey, not a blip, as you can see in the select emails below. Each new message puts extra reasons to use PayPal in front of the user, educating over time instead of overwhelming all at once.

Be sensitive and authentic

Det är ingen hemlighet att ekonomi kan vara ett känsligt ämne för många människor.

According to a nyligen genomförd undersökning of over 1,000 U.S. adults, 85% of us are sometimes stressed about money, while a whopping 30% of Americans admit they’re ständigt stressed about money. You’d think they’d jump at any chance of alleviating this stress. But the truth is more nuanced.

Enligt Wells Fargo anser 44 % av amerikanerna att privatekonomi är det enskilt svåraste ämnet för dem att diskutera med andra. Med så mycket känslor och osäkerhet kopplat till själva ordet "ekonomi" kan det vara svårt för en marknadsförare att göra ett bra första intryck.

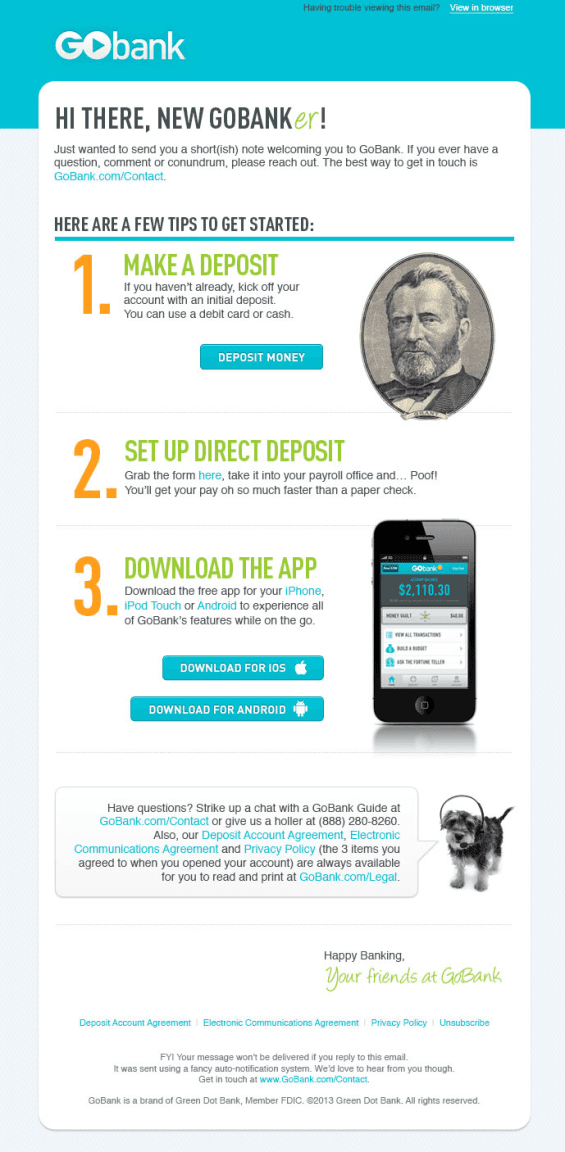

Så din första uppgift är att få mottagaren att känna sig bekväm med ditt budskap. När du utformar ditt onboarding-e-postmeddelande är det viktigt att ha dessa känsligheter i åtanke. Att tacka för att de registrerat sig hos dig är det första du bör göra, men undvik att bli för sentimental.

If they’ve signed on with you, they probably responded to branding and key messages that you ought to follow through on. GoBank takes a wry, cut-to-the-chase approach with the thank-you message below, which aligns with their positioning as the oh-so-friendly provider who’s going to defeat fears about how to manage your money by making banking kul! Välkommen till festen!

Gör det relaterbart

Även om det kanske är en missuppfattning så är "ekonomi" för många synonymt med "tråkigt" och "komplicerat". Det är ditt jobb att bevisa motsatsen.

Technical jargon and detailed explanations can exhaust the reader, or drive them to simply delete your email and move on. Or, worse yet, force a change of heart as they consign you till Spam folder and delete the app. While it may be tough, coming up with kreativa sätt to make the onboarding experience energizing and motivating, not deadly dull, are critical.

Take another look vid GoBank example above. Or this Facebook ad by Förmögenhet enkelt. While it’s not an email, the idea is the same – they’re targeting by customer segment.

Den ads feature an influencer from a popular TV show, but with an angle that’s relaterbar and appealing for its intended audience. It’s built around a personal anecdote the target can understand, not any kind of a hard sell.

Gör det visuellt

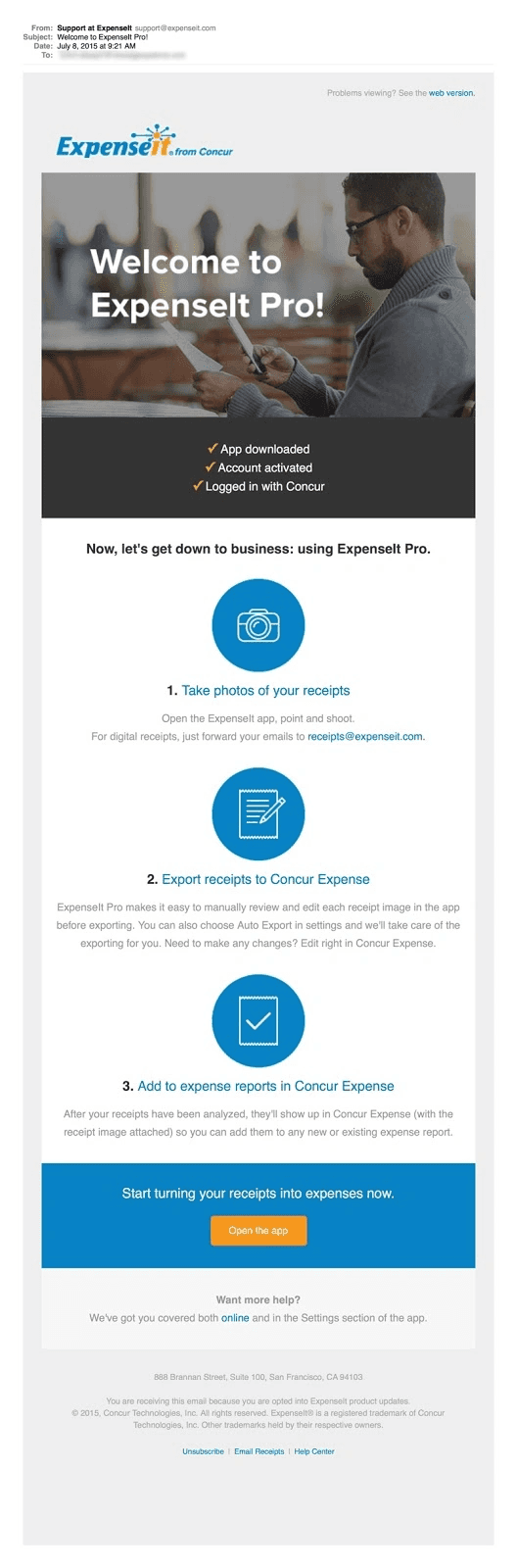

Another good way to stand out from the crowd? Including images in your emails that give your reader a graphic idea of what they’re signing up for. 65% av befolkningen är visuella inlärare, so it’s worth playing to this.

Istället för att kommunicera via text kan du erbjuda bilder som berättar historien - till exempel en visualiserad genomgång av hur man använder din app. Detta är särskilt viktigt när man betänker att över hälften av oss får tillgång till vår e-post via mobila enheter. Storytelling via bra grafisk design bör ha företräde framför "wall-of-text"-texter som de ändå inte har tid - eller lust - att ta sig igenom.

This clean and simple-to-understand email from Utgifter does exactly that, and its own clarity reminds them why they wanted the app in the first place: Because of its ease of use.

Excite them tidig about using the product

Stoke their tidig enthusiasm for your product by building a few tidig – and surprising – messages into your onboarding flow that spotlight the product’s functionality. Send a hearty “congratulations!” when they first try out a new feature, for instance, and add pageantry and flair to even your most mundane, baseline functions. In short, the spelifiering that makes apps appealing to users should extend into your emails.

See what Kreditvärdighet does in the notification below? As a user, naturligtvis you’re using the platform to keep track of – and improve, one hopes – your credit score. Credit Karma makes a big deal out of the fact the user’s score has gone up with this triggered alert, and drives them to check to see whether or not they can get a loan approval for that superyacht (actually, a 2016 Camry) they’ve got their eye on.

Another version of this tactic? Send them actual rewards for using features, like FREE! upgrades or promotional incentives. Remember, you want them as fullt engagerad as possible as early and ofta as possible.

Påminn dem om att de är saknade

If there’s a hiccup in their onboarding flow, or they stop using your product, aldrig let them go without a winback message of some sort. It aldrig hurts to send them a gentle, or funny, or even urgent reminder that they’re a valued user and you’d love to see them back in the fold, as Enkel did in the message below.

Mint are experts at onboarding, and their re-engagement message to delinquent users is no exception. Den subject line it uses? “We miss you already.” Nothing like tugging vid heartstrings while also reminding people of the pragmatisk reasons they were interested in you in the first place.

Och om allt annat misslyckas finns det en annan morot som du kan erbjuda - incitament att komma tillbaka i form av rabatter, gratis uppgraderingar eller andra lockbeten.

Få ombord mer effektiv onboarding

Email is a powerful component in the onboarding flow, and a natural complement to in-app notifications and SMS messaging. The best practices we’ve just walked through are just hörnstenar for a more customized, fine-tuned approach to building strong bonds with a user base.

Men det är viktigt att först få rätt på blockering och tackling. Först då kan en fintech-marknadsförare skapa sig förutsättningar för ytterligare framgång genom att optimera framtida campaigns.